Methodology

With this approach the goal is to take positions where risk is limited compared to the reward it can be achieved, therefore I look for

Asymmetry in the results I can generate

How the goal is achieved?

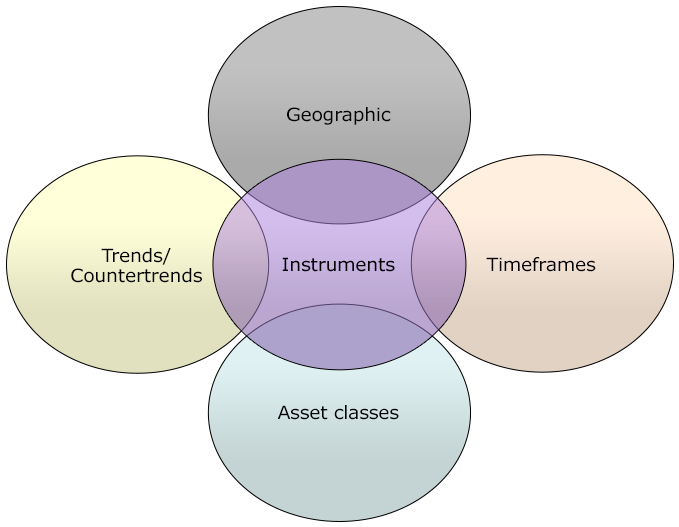

Diversification

Diversification is achieved:

- By instruments: futures, stocks and etfs.

- By asset classes: equities and equity related, commodities and bonds (last one only via futures or etfs).

- By geographic extension: (US, Europe, Latam and Asia).

- By time frame: trades are exploited in a multi time frame environment ( 60 min, 240 min, daily, weekly and monthly).

- By trend directions: in normal conditions not all the above instruments trend in the same direction at the same time.

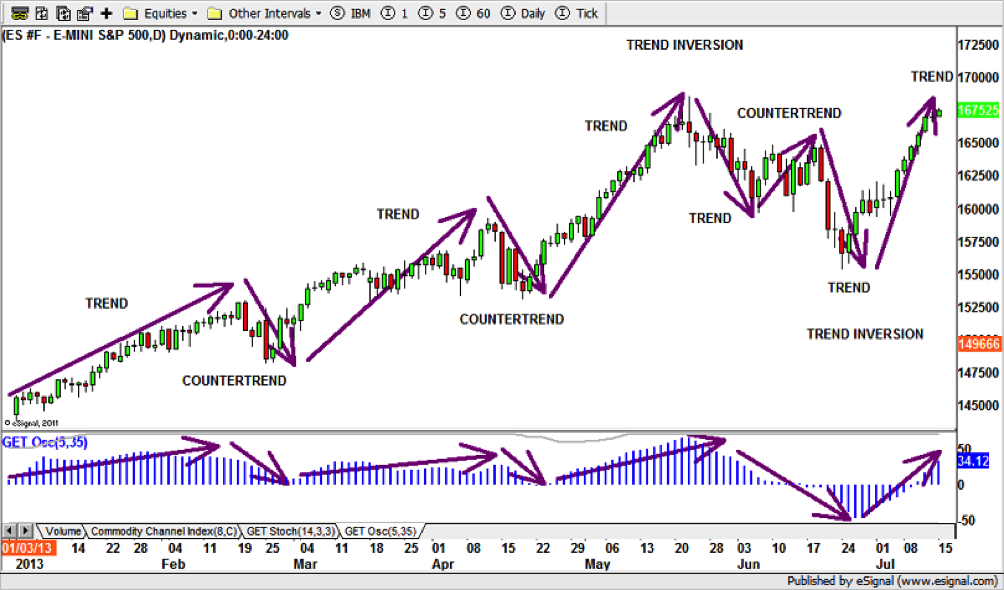

Trend recognition

Trend trades: wider in time and price.

Countertrend trades: limited in time and price.

No Trend: typically no trades or countertrend type of trades

Multi time frame trades

Trades can be exploited in a multi time frame environment due to:

- Fractal theory: A fractal is "a rough or fragmented geometric shape that can be split into parts, each of which is (at least approximately) a reduced-size copy of the whole,"a property called self-similarity.

- Technical indicators: such as MACD, Stochastic and Fibonacci. If those indicators (as an example) are not violated, trend is intact. Otherwise a new trend is in formation.

Risk Management

Risk Management is involved in the following areas:

- Constant review of the fear factors:

- VIX Index (historical range 14-18: a red light is on when below 14 and above 18)

- Bund / US Treasuries as flight to safe heaven (yield vs. inflation)

- Size limits of each position on overall portfolio in terms of stop loss dollar amount.

- Active money managment to constantly revise overall fixed total market risk accepted.

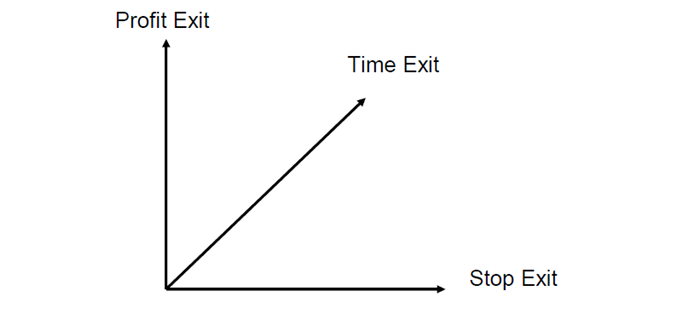

- Rigourus execution of three dimensional exits.

How a position is taken

Constant monitor all the mentioned instruments for signals, either through software screeners or human generated signals.

Once highlighted a possible candidate, a first 25% of the full size is allocated with a stop loss.

As the position goes in my favour, incremental 25% is added on retracements until full 100% is reached, with stop losses moved to break even.

A monetary stop loss is allocated first and then calculate position sizing backwards.

$$ Stop loss → % Stop loss → Size of position

How a position is exited

Exits are three dimensional: